2021-09-22

Short-term Decline of Index and Falling Operating Costs

Research Group of Economic Daily – PSBC Small and Micro-sized Enterprise Operating Index

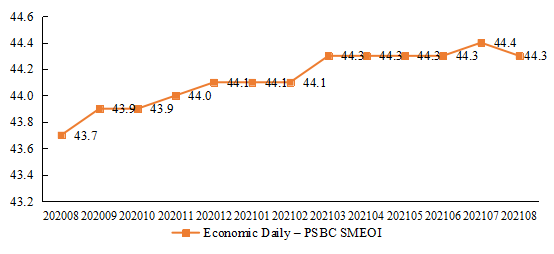

The Economic Daily – PSBC Small and Micro-sized Enterprise Operating Index (hereinafter referred to as “SMEOI”) reported 44.3 in August, down by 0.1 point from the previous month (See Fig.1). Of the eight component indices, one index went up, one remained unchanged and the other six went down. Specifically, the market index was 39.9, down 0.1 point; the purchasing index stood at 42.3, down 0.2 point; the performance index registered 44.4, down 0.1 point; the expansion index read 42.5, down 0.1 point; the confidence index posted 41.5, down 0.1 point; the financing index recorded 52.9, on par with that in the previous month; the risk index dopped 0.1 point to 48.9; and the cost index closed at 63.1, up 0.1 point. SMEOI has improved steadily since August 2020.

Fig. 1 Economic Daily – PSBC SMEOI

Fig. 2 Component Indices of Economic Daily – PSBC SMEOI

In the past 12 months, SMEOI went up steadily as a whole. Specifically, the market index and the performance index continued to recover; the confidence index, the purchasing index, the expansion index and the risk index fluctuated at a certain level; and the financing index and the cost index remained above the prosperity threshold --altogether indicated an ongoing improvement in financing environment and a continuous decrease in comprehensive costs for micro and small-sized enterprises (MSEs).

Table 1 Changes of SMEOI and Component Indices in the Past 12 Months

Index name | SMEOI | Market index | Purchasing index | Performance index | Expansion index | Confidence index | Financing index | Risk index | Cost index |

Sep-20 | 43.9 | 39.3 | 42.2 | 44.0 | 43.0 | 41.4 | 52.2 | 48.5 | 62.7 |

Oct-20 | 43.9 | 39.3 | 42.4 | 44.0 | 42.9 | 41.6 | 52.0 | 48.4 | 62.4 |

Nov-20 | 44.0 | 39.5 | 42.3 | 44.2 | 42.7 | 41.3 | 52.3 | 48.5 | 62.6 |

Dec-20 | 44.1 | 39.5 | 42.1 | 44.2 | 42.8 | 41.1 | 52.8 | 48.8 | 62.5 |

Jan-21 | 44.1 | 39.6 | 42.2 | 44.4 | 42.6 | 41.0 | 52.8 | 48.8 | 62.6 |

Feb-21 | 44.1 | 39.5 | 42.1 | 44.3 | 42.6 | 41.4 | 52.8 | 48.9 | 63.2 |

Mar-21 | 44.3 | 39.8 | 42.4 | 44.5 | 42.7 | 41.4 | 52.9 | 48.9 | 62.9 |

Apr-21 | 44.3 | 39.7 | 42.4 | 44.6 | 42.7 | 41.4 | 52.9 | 48.8 | 62.9 |

May-21 | 44.3 | 39.5 | 42.2 | 44.5 | 42.8 | 41.1 | 53.2 | 49.2 | 63.2 |

Jun-21 | 44.3 | 39.8 | 42.4 | 44.3 | 42.6 | 41.4 | 52.9 | 48.9 | 63.0 |

Jul-21 | 44.4 | 40.0 | 42.5 | 44.5 | 42.6 | 41.6 | 52.9 | 49.0 | 63.0 |

Aug-21 | 44.3 | 39.9 | 42.3 | 44.4 | 42.5 | 41.5 | 52.9 | 48.9 | 63.1 |

One of the seven industry indices stayed unchanged and the remaining six went down.

As to SMEOI, one of the seven industry indices stayed unchanged and the remaining six went down.

To be specific, the purchasing index of the agriculture, forestry, animal husbandry & fishery industry went up 0.1 point; the financing index of the manufacturing industry rose 0.1 point; the cost index of the construction industry, the transportation industry, the wholesale & retail industry and the accommodation & catering industry increased by 0.1 point, 0.1 point, 0.2 point and 0.1 point, respectively; and both of the financing index and cost index of the service industry climbed 0.1 point.

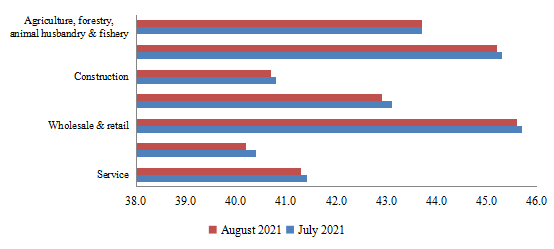

Fig. 3 Comparison of Industry Indices

The index of the agriculture, forestry, animal husbandry & fishery industry reported 43.7 in August, on par with the previous month. To be specific, the market index and the performance index recorded 39.9 and 43.7 respectively, both being at the same level as the previous month, while the purchasing index rose by 0.1 point to 41.5. According to the survey results, the output of MSEs in the agriculture, forestry, animal husbandry & fishery industry increased by 0.1 point, orders up 0.2 point, income from principal business down 0.2 point, raw material procurement up 0.1 point, raw material inventory up 0.2 point, profit down 0.1 point and gross profit margin up 0.1 point.

The index of the manufacturing industry reported 45.2, down 0.1 point. To be specific, the market index stood at 39.1, the same as the previous month, while the purchasing index and the performance index were 39.6 and 48 respectively, down 0.2 point and 0.1 point. According to the survey results, the output, orders (OEM) and gross profit margin of MSEs in the manufacturing industry remained the same as the previous, while the income from principal business (income from product sales), raw material procurement, raw material inventory and profit went down 0.1 point, 0.4 point, 0.1 point and 0.2 point, respectively.

The index of the construction industry reported 40.7, down 0.1 point. To be specific, the market index, the purchasing index and the performance index were 37.1, 38.4 and 41.8 respectively, down 0.1 point, 0.1 point and 0.2 point. According to the survey results, the engineering volume went down by 0.3 point, new construction contract value down 0.3 point, project settlement revenue down 0.1 point, raw material procurement down 0.4 point, raw material inventory down 0.1 point, and profit and gross profit margin decreased by 0.4 point and 0.2 point, respectively.

The index of the transportation industry reported 42.9, down 0.2 point. To be specific, the market index, the purchasing index and the performance index were 40.7, 36.9 and 43.1 respectively, down 0.1 point, 0.3 point and 0.2 point. According to the survey results, the business reservation volume of MSEs in the transportation industry remained the same as that of the previous month, while freight volume (passenger/cargo) went down by 0.2 point, income from principal business down 0.2 point, raw material procurement down 0.3 point, raw material inventory down 0.3 point, and profit and gross profit margin decreased by 0.2 point and 0.1 point, respectively.

The index of the wholesale & retail industry reported 45.6, down 0.1 point. To be specific, the market index, the purchasing index and the performance index were 42.8, 49.2 and 42.5 respectively, all down by 0.1 point. The sales order volume, sales amount, purchase volume, profit and gross profit all decreased by 0.1 point, while new investments and the number of new employees remained the same as last month.

The index of the accommodation & catering industry reported 40.2, down 0.2 point. To be specific, the market index, the purchasing index and the performance index were 39.1, 39.1 and 39.9 respectively, all down by 0.3 point. The business volume went down by 0.3 point, income (turnover) from principal business down 0.3 point, raw material procurement down 0.3 point, raw material inventory down 0.2 point, and profit and gross profit margin decreased by 0.3 point and 0.2 point, respectively. New investments (storefronts, business area and equipment) remained the same as last month.

The index of the service industry reported 41.3, down 0.1 point. To be specific, the market index, the purchasing index and the performance index were 36.7, 41.1 and 39.5 respectively, down 0.1 point, 0.3 point and 0.2 point. The business reservation volume remained the same as last month, while the business volume went down by 0.2 point, income (turnover) from principal business down 0.1 point, raw material procurement down 0.4 point, raw material inventory down 0.3 point, and profit and gross profit margin decreased by 0.2 and 0.1 point, respectively.

Table 2 Changes to Each Industry Index by Component Indices

Aug. vs. Jul. | SMEOI | Market index | Purchasing index | Performance index | Expansion index | Confidence index | Financing index | Risk index | Cost index |

SMEOI | -0.1 | -0.1 | -0.2 | -0.1 | -0.1 | -0.1 | 0.0 | -0.1 | 0.1 |

Agriculture, forestry, animal husbandry & fishery industry | 0.0 | 0.0 | 0.1 | 0.0 | 0.0 | -0.1 | 0.0 | -0.3 | -0.2 |

Manufacturing industry | -0.1 | 0.0 | -0.2 | -0.1 | -0.1 | -0.1 | 0.1 | -0.2 | 0.0 |

Construction industry | -0.1 | -0.1 | -0.1 | -0.2 | 0.0 | -0.3 | 0.0 | -0.1 | 0.1 |

Transportation industry | -0.2 | -0.1 | -0.3 | -0.2 | -0.2 | -0.1 | -0.1 | 0.0 | 0.1 |

Wholesale & retail industry | -0.1 | -0.1 | -0.1 | -0.1 | 0.0 | 0.0 | -0.1 | 0.0 | 0.2 |

Accommodation & catering industry | -0.2 | -0.3 | -0.3 | -0.3 | -0.1 | -0.3 | -0.1 | -0.1 | 0.1 |

Service industry | -0.1 | -0.1 | -0.3 | -0.2 | -0.2 | -0.1 | 0.1 | -0.1 | 0.1 |

One out of the six regional indices remained the same and the other five went down.

Of the six regional indices, one remained the same as the previous month and the other five went down.

The North China index reported 42.1, down 0.1 point. Specifically, the market index was 37.1, down 0.1 point; the purchasing index stood at 39.4, down 0.2 point; the performance index registered 41.9, down 0.1 point; the expansion index read 37.9, down 0.1 point; the confidence index posted 38.3, down 0.1 point; the financing index recorded 54.2, on par with that in the previous month; the risk index dropped 0.1 point to 47.1; and the cost index closed at 68.4, up 0.2 point.

Fig. 4 Regional Development Index

The Northeast China index reported 40.9, down 0.1 point. Specifically, the market index was 34.8, down 0.1 point; the purchasing index stood at 37.5, down 0.1 point; the performance index registered 41.4, down 0.1 point; the expansion index was 38.7, on par with that of last month; the confidence index posted 42.3, down 0.2 point; the financing index recorded 49.9, the same as last month; the risk index read 53.6, down 0.1 point; and the cost index closed at 69.2 after a drop of 0.1 point.

The East China index reported 45.4, down 0.1 point. Specifically, the market index was 43.8, down 0.1 point; the purchasing index stood at 45.2, down 0.2 point; the performance index registered 45.8, down 0.1 point; the expansion index dropped 0.2 point to 44.2; the confidence index posted 41.8, down 0.1 point; the financing index recorded 49.5, the same as last month; the risk index read 48.3, down 0.1 point; and the cost index closed at 60.9, the same as last month.

The Central & South China index reported 46.5, down 0.1 point. Specifically, the market index was 44.3, down 0.1 point; the purchasing index stood at 45.6, down 0.3 point; the performance index registered 44.4, down 0.2 point; the expansion index stood at 44.5, down 0.1 point; the confidence index posted 41.7, down 0.2 point; the financing index recorded 55.3, up 0.1 point; the risk index read 47.3, down 0.1 point; and the cost index closed at 64.8 after a rise of 0.1 point.

The Southwest China index reported 43.6, on par with the previous month. Specifically, the market index, the purchasing index and the performance index registered 41.5, 44.4 and 44.7, respectively, the same as the previous month; the expansion index stood at 43.8, up 0.1 point; the confidence index posted 37.9, up 0.1 point; the financing index recorded 48.3, down 0.1 point; the risk index read 49, on par with last month; and the cost index closed at 60.4 after a rise of 0.2 point.

The Northwest China index reported 41.5, down 0.1 point. Specifically, the market index was 37.3, down 0.1 point; the purchasing index stood at 37.4, down 0.2 point; the performance index registered 44.3, down 0.2 point; the expansion index stood at 39.4, down 0.1 point; the confidence index posted 33.2, down 0.2 point; the financing index recorded 49.9, down 0.1 point; the risk index read 48.1, down 0.1 point; and the cost index closed at 65.1 after a rise of 0.2 point.

Table 3 Changes to Each Regional Index by Component Indices

Aug. vs. Jul. | SMEOI | Market index | Purchasing index | Performance index | Expansion index | Confidence index | Financing index | Risk index | Cost index |

SMEOI | 0.1 | 0.2 | 0.1 | 0.2 | 0.0 | 0.2 | 0.0 | 0.1 | 0.0 |

North China | 0.3 | 0.5 | 0.4 | 0.1 | 0.4 | 0.0 | 0.2 | -0.2 | |

Northeast China | -0.1 | -0.1 | -0.2 | -0.2 | -0.1 | 0.0 | 0.0 | 0.0 | 0.2 |

East China | 0.1 | 0.2 | 0.2 | 0.2 | 0.1 | 0.0 | 0.0 | 0.1 | 0.1 |

Central & South China | 0.3 | 0.4 | 0.4 | 0.2 | 0.0 | 0.0 | 0.3 | 0.1 | 0.1 |

Southwest China | 0.1 | 0.0 | 0.4 | 0.3 | 0.1 | 0.0 | 0.1 | 0.1 | -0.2 |

Northwest China | 0.2 | 0.3 | 0.0 | 0.5 | -0.2 | 0.2 | 0.0 | 0.1 | -0.1 |

The financing index remained at a high level

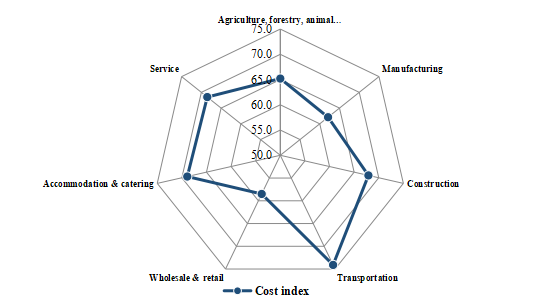

In August, the cost index reflecting the costs of MSEs gained 0.1 point to 63.1, indicating decreasing costs of enterprises. By industry, the cost index of the agriculture, forestry, animal husbandry & fishery industry was 65.2, down 0.2 point; that of the manufacturing industry reported 62.1, the same as last month; that of the construction industry read 67.9, up 0.1 point; that of the transportation industry registered 74.1, up 0.1 point; that of the wholesale & retail industry stood at 58.5, up 0.2 point; that of the accommodation & catering industry posted 68.9, up 0.1 point; and that of the service industry was 68.5, up 0.1 point.

According to the survey results, the raw material procurement cost index of MSEs in the agriculture, forestry, animal husbandry & fishery industry decreased significantly by 0.3 point, the processing cost index of MSEs in the manufacturing industry decreased slightly by 0.1 point; both of the overall operating cost index and raw material procurement cost index of MSEs in the construction industry increased by 0.1 point; the overall operating cost index of MSEs in the transportation industry increased by 0.1 point; the overall operating cost index of MSEs in the wholesale & retail industry registered the largest increase of 0.3 point; the overall operating cost index of MSEs in the accommodation & catering industry rose the most by 0.2 point; and the overall operating cost index of MSEs in the service industry rose the most by 0.3 point.

Fig. 5 Cost Index by Industry

In August, the financing index reflecting the financing needs of MSEs stood at 52.9, the same as last month. To be specific, the financing index of MSEs in the agriculture, forestry, animal husbandry & fishery industry was 50.2, on par with the previous month; that in the manufacturing industry was 55, up 0.1 point; that in the construction industry was 50.5, the same as last month; that in the transportation industry was 51.5, down 0.1 point; that in the wholesale & retail industry was 52, down 0.1 point; that in the accommodation & catering industry was 47.4, down 0.1 point; and that in the service industry was 54, up 0.1 point.

Seen from the survey results, the next-month financing demand index for MSEs in the agriculture, forestry, animal husbandry & fishery industry and the service industry remained the same as that in the previous month; that of the manufacturing industry witnessed an increase of 0.1 point; and those of the construction industry, the transportation industry, the wholesale & retail industry and the accommodation & catering industry witnessed a decrease of 0.1 point.